We’ve all heard the old adage, “don’t put all your eggs in one basket,” which is a great way to think about diversification. But what does diversification actually mean, and is it right for you? What about the stories of life-changing investment returns from early investors in a company, who took a large position and made a fortune? On the other hand, what about the grand new ideas who don’t make it and take their investor’s money down the tubes with them? Is the joy of a life-changing potential return worth the pain of losing a large investment?

While we may all have heard the adage about all your eggs in one basket, I’ve found that investors are often perplexed when it comes to what diversification really means. Today in our series on risk, we’re going put to bed some of the mystery surrounding investment portfolio diversification.

Diversification: What Does It Really Mean?

In a word, diversification means “different.” However, it does not mean filling a portfolio with randomly selected mutual funds or buying a bunch of dividend paying stocks. True diversification comes from owning assets that behave differently from one another. A portfolio filled with 25 different mutual funds spread out across various industries might still be less diversified than a portfolio holding two funds.

Asset classes move in different directions, depending on any given number of factors. All too often, last year’s winners are this year’s losers.

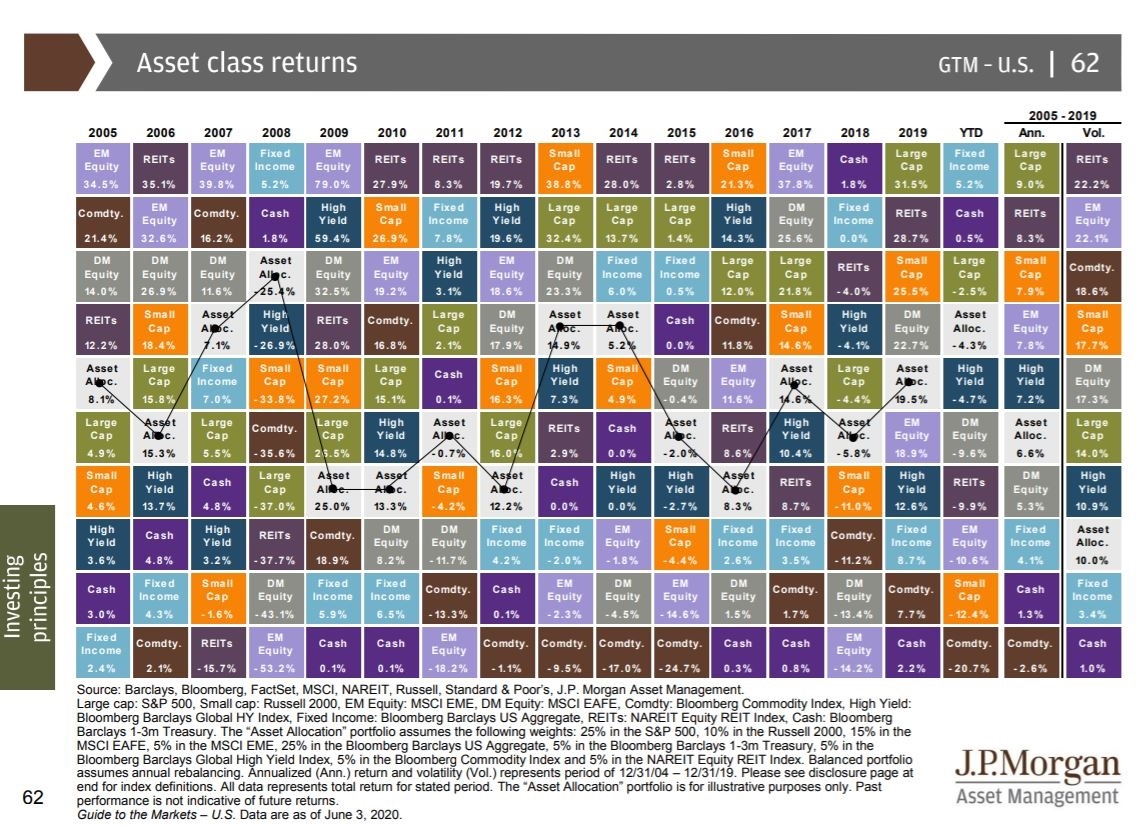

Let’s use the above chart from J.P. Morgan Asset Management’s Guide to the Markets as an example.

In a 15-year stretch from 2005 to 2019, real estate investment trusts (REITs) were the only asset classes to carry the mantle of “Best Returns” for consecutive years. Emerging Markets and REITs combined for best returns in 10 of the 15 years measured. So, looking back, you should have just invested in those two asset classes, right? Not so fast. Their overall returns for the 15-year period actually lagged large cap stocks, despite having the highest volatility of any asset class[1].

Predicting the future path of individual asset classes is the dream of all investors, but it’s difficult to do without Doc Brown’s DeLorean. The Bloomberg Commodity Index was the third-best surveyed performing asset class (of assets represented in this chart) over the 15-year time period despite never finishing first annually in a single year. Small-cap stocks had some play as well, with two top returns in 2013 and 2016, as did large cap stocks with a top return in 2019.

An investor who only invested in large-cap assets from 2005 to 2019 failed to match the returns offered by small cap and high yield assets. An investor who invested in all three asset classes did better on average, but still didn’t get full reward from small caps. An investor who took the approach of asset allocation was consistently in the middle of the pack when it comes to returns. Not only that, they actually experienced some of the lowest volatility. Why is that?

Investment returns aren’t awarded like Olympic medals. It doesn’t really matter what investment or asset class is number one in a year. What matters is how the portfolio works together over the long haul. This is where diversification comes into play.

Diversification and Correlation

Correlation helps evaluate diversification by measuring how closely the assets we buy move in relation to one another. Think back to the 20-asset portfolio vs 2-asset portfolio. If all 20 assets in the larger portfolio are highly correlated, they’ll move up and down in lockstep. That might be good news if the trend for those assets is moving up, but they’ll also make moves to the downside in unison. If the two assets in the 2 asset portfolio aren’t correlated, they would not move in lock-step, and could reduce the overall portfolio volatility.

Diversification involves regret. A diversified portfolio with uncorrelated assets will always fail to match the returns of the best-performing assets. Comfort has a price—if we want to sleep at night and not worry about our investment risk, diversification is required. But risk seekers who willing put all the chips on the table might feel differently.

Ways To View Risk Reduction

Risk reduction is relative to the investor and their temperament. Andrew Carnegie didn’t exactly agree with the parental advice we were offered growing up, and instead said, “Put all your eggs in one basket. And then watch that basket.” In Carnegie’s view, the way to get rich was to ignore diversification and concentrate on one or two big ideas.

For some investors, an investment’s risk does not matter to them. The real risk is missing the potential for major returns. They’d rather hit it big than live with the regret of missing out on the once in a lifetime opportunity.

However, we’ve found that for those investors who are approaching retirement or already retired, major swings in a portfolio can be uncomfortable. In other words, they like the slow and steady tortoise instead of the fast and exciting hare.

While your highs may not be as high in a diversified portfolio, your lows aren’t likely to be as low either. If you’d like to discover the true level of your portfolio’s diversification, contact an advisor at Good Life Financial Advisors of NOVA today for a free portfolio second look.

Work with a CFP® Professional

When we diversify our portfolios, we sacrifice returns to give us the best shot at preventing massive losses. There will always be an asset class outperforming a diversified portfolio—always. And while diversification may not be the fastest path to building wealth, it’s shown to be a good approach to maintaining your nest egg over time. If you need assistance diversifying your portfolio, Speak with Josh Strange, a CERTIFIED FINANCIAL PLANNER™ practitioner at Good Life Financial Advisors of NOVA today.

[1] As measured by standard deviation