As we discussed in our last post, insurance protects us and our loved ones from financial ruin should an unexpected event occur, like an illness, accident, natural disaster, or the dreaded lawsuit! All insurance functions under the same basic system: the insurance company collects monthly premiums from clients and puts the money into a pool. Should a client paying into the pool need money for an expensive surgery or home repair, the insurance company reimburses them from the pool if it is determined to be something that policy covers.

Insurance policies are priced based on the likelihood of the client needing to make a claim. For example, health insurance is more expensive for older folks who are more likely to experience illness or injury, while car insurance is more expensive for accident-prone young drivers. That said, everyone has different needs when it comes to insurance, but we all have something worth protecting. Here are six essential types of insurance to consider when reviewing your financial well-being.

Contact us to schedule a no-cost insurance review with Good Life Financial Advisors of NOVA!

Health Insurance

Health insurance is perhaps the most important type of insurance you can buy. Sustained health is a gift, and unexpected illnesses and injuries are simply a part of life. Everyone needs routine checkups and common care, but serious maladies can result in large out-of-pocket costs for patients. Some form of health insurance is absolutely necessary for everyone, even if it’s a catastrophic plan reserved for only the most life-threatening incidents.

Auto Insurance

Auto insurance is required in the majority of states. However, these minimums are not enough coverage, since a major accident can rack up not only damage repairs, but big liability claims for injured parties. Increasing your limits beyond the minimum does not generally cost a lot more. If you ever find yourself at fault in an accident, the cost for higher limits will prove to be a down-right bargain!

Home and Renters Insurance

Do you have a roof over your head and valuables in your home? Then you likely need homeowners or renter’s insurance. This will allow you to protect yourself should your property or belongings become damaged or destroyed in an event like a fire, or if someone gets injured at your home and pursues a claim. Home and renter’s insurance can often be bundled with your auto insurance carrier to reduce the cost of each individually.

Life Insurance

Not everyone needs life insurance. If you have no significant other or dependents who lean on you for support, you can probably forgo life insurance for the time being. Or, once you become an empty nester, your existing coverage may not be necessary any longer. This would be a great time for an insurance review.

However, for those who do have a need, life insurance is crucial. If others depend on your income and would be hurt if that income went away, then you probably need life insurance. Life insurance doesn’t protect you—it protects your loved ones.

Contact us to discuss your insurance needs with a professional from Good Life Financial Advisors of NOVA!

Disability Insurance

While life insurance is certainly important, the fact is, you’re more likely to become disabled than die in your working years. If a physical injury or illness would reduce your capacity to perform your job, disability insurance is definitely something to consider. There are both short- and long-term disability insurance options, and they’re often available through your employer. When it comes to disability insurance, there are a lot of nuances, and you should discuss your individual needs with your financial advisor.

Long-Term Care Insurance

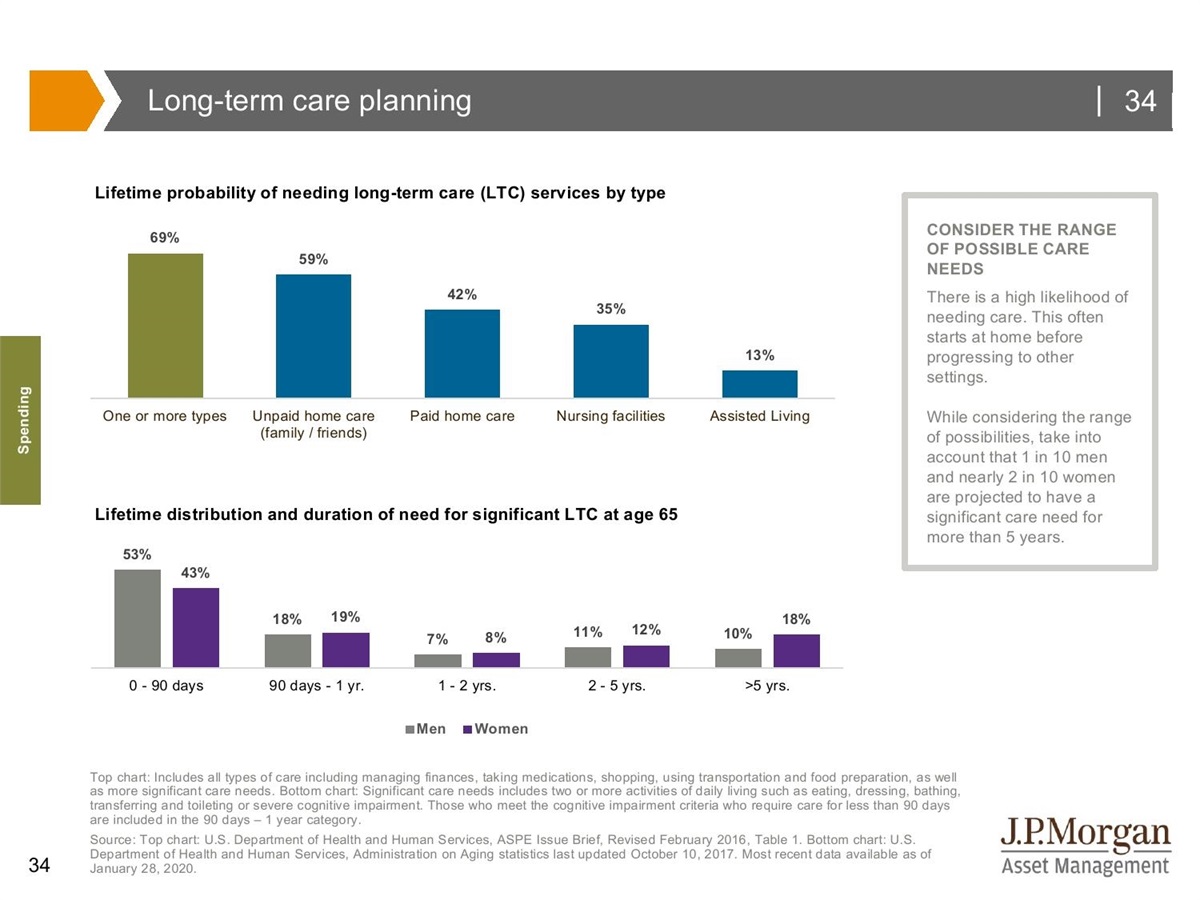

We should all be so lucky to grow old, but even the lucky ones eventually suffer the effects of aging. According to the US Department of Health and Human Services, 69% of the US adults who live to age 65 will need some sort of long-term care services. Long-term caregivers are wonderful and compassionate people, but their services aren’t cheap. Long-term care insurance can help cover the costs of this type of medical assistance so you don’t need to solely rely on retirement funds or savings. We will be more fully discussing long-term care in a later blog post.

Other Types of Insurance to Consider

Here are some other types of insurance you might consider including in your financial plan:

- Pet Insurance. Emergency veterinary visits can be expensive, so pet insurance provides coverage for when your furry companions need a doctor. Some plans are comprehensive, while others cover only injury or basic care. Your pets are part of your family too! Don’t neglect them when reviewing your insurance options.

- Identity Fraud Insurance. Identity theft is one of the fastest-growing crimes around the globe. Even the most careful individual can be victimized by identity hackers, who can perform ruthless acts with your information. Imagine someone maxing out a $50,000 credit card in your name! Identity fraud crimes can be tedious to clean up and the process often takes years, so identity fraud insurance might be worth considering.

- Umbrella Insurance. Umbrella insurance is a form of insurance that offers higher levels of personal liability protection. This becomes especially important as your net worth increases. If you’ve maxed out your auto or homeowners insurance and still don’t have enough coverage to protect you, an umbrella policy can fill that gap.

Work with a Professional

To be prepared for both the expected and unexpected, you might consider including these six types of insurance in your financial plan. It’s also crucial to find the right financial advisor to assist you in creating a plan that works for your specific needs. Contact us to schedule a no-cost insurance review with Good Life Financial Advisors of NOVA!

Disclosure

This material contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice.